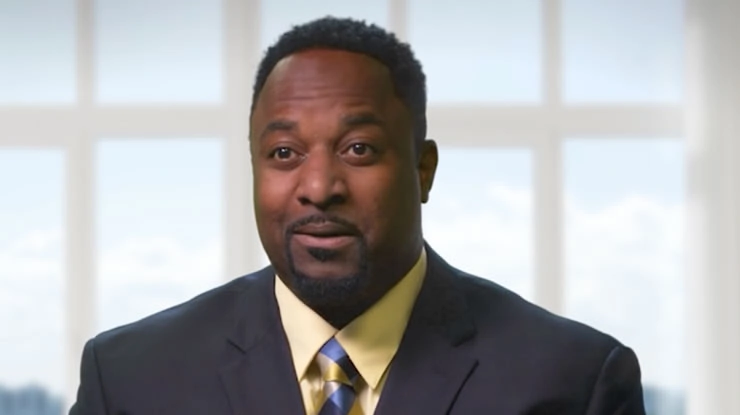

The Internal Revenue Service pays awards to whistleblowers who notify the federal agency of tax law violations that defraud the government. At The Cochran Firm, D.C., our team of whistleblower attorneys provide representation to whistleblowers that is informed through decades of high-profile, high-stakes legal practice. If you are aware of serious tax underpayments, of schemes to defraud the government out of owed revenue, or other tax fraud activities, please contact us today to receive a free case evaluation.

Typical types of tax fraud include overstating deductions, underreporting income, keeping multiple sets of accounting records, false recordkeeping, fraudulent shifting of assets to avoid taxes, concealing assets, and using trusts for an illegal tax-avoiding purpose. The IRS Whistleblower Program has a backlog of more than 2,000 claims and it is critical to present the best case possible in order to increase the chance of receiving compensation as a whistleblower. At The Cochran Firm, D.C., we work with tax specialists, accounting professionals, and other experts in order to draft, compile, and ultimately submit an IRS whistleblower claim that maximize the odds of a successful case. Because strict time limits usually apply to filing an IRS whistleblower claim, we recommend getting in touch with our office at your earliest convenience.

Although these rules may change based upon your individual circumstances, which is why we strongly recommend consulting with us, a whistleblower must generally meet the following criteria in order to be eligible for an award under IRS Whistleblower Program: