Home healthcare companies, nursing homes, cancer treatment, substance abuse treatment centers, and other medical facilities have recently been brought to justice after whistleblowers stepped forward and reported fraudulent activity. Unscrupulous nursing homes and medical care companies waste valuable government resources that could be used to care for patients who need the care.

The False Claims Act (FCA) provides an incentive for whistleblowers to stop fraud and prevent further abuses of public health programs. Under the whistleblower provision of the FCA, individuals represented by attorneys may file claims on behalf of the government and receive a portion of the government’s recovery from a qui tam whistleblower lawsuit. The U.S. Department of Justice and Department of Health and Human Services have recently declared that reducing health care fraud and abuse is a priority for federal agencies. Since 2009, the DOJ has recovered more than $13.4 billion in cases related to fraud against federal healthcare programs

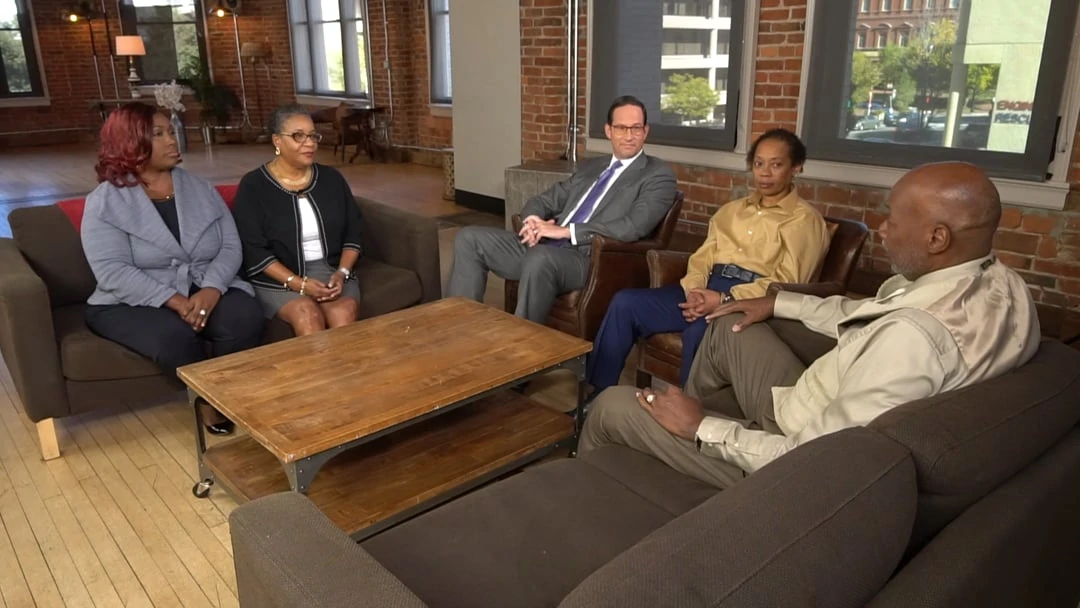

By retaining a whistleblower attorney with The Cochran Firm, D.C., you will have an experienced advocate who will represent your best interests and fight to hold wrongdoers accountable for placing profits above patients. The legal area of fraud and its interaction with federal health care programs is complex and involves a varied patchwork of statutes and regulations, including the False Claims Act, the Anti-Kickback Statute, the Stark Statute, and many other rules. We will guide you through the legal process and employ our expertise and experience to develop a case strategy particular to your situation with the goal of obtaining the highest possible compensation for you.

When the government intervenes in a Medicare fraud or Medicaid fraud case filed under the False Claims Act, the whistleblower who provided original information and was the first to file a qui tam lawsuit is eligible to receive between 15% and 25% of a subsequent settlement or verdict. If the whistleblower files a case without government intervention, the whistleblower is eligible to receive up to 30% of a settlement or verdict. The whistleblower’s award may be higher or lower depending upon the whistleblower’s involvement in the case and on the quality and importance of the documents and information that he or she provides.